Aerial Riggers & Life Insurance

Request a Callback

By clicking on submit I / We give consent for you to call me / us on the number provided to discuss my / our financial requirements.

Caring - Understanding - Reliable - Advice

Home » Occupations » Aerial Riggers

Aerial Riggers & Life Insurance

Life insurance for aerial riggers will need to be placed with specific insurers to optimise the chance of getting cover at standard terms. This means no price increase.

Life insurance for aerial riggers will need to be placed with specific insurers to optimise the chance of getting cover at standard terms. This means no price increase.

To help you find the right insurer for you we will be asking you:

- What height do you usually work at?

- How much of your working week is spent at that height?

- What is the greatest height that you might work at?

- How much of your working week is spent on the rigs, doing admin work or acting in a supervisory role?

- Are you based in the UK or work abroad?

For people who work below 40 feet it is likely that the life insurance application will be accepted at normal rates with most insurers. If you are regularly working at over 40 feet your application should be placed with a specific insurer who looks favourably at people working at heights.

Our industry trained advisers are here to help you find the right insurer for your circumstances.

Aerial Riggers & Critical Illness Cover

Critical illness cover pays out a cash lump sum of money, if you are diagnosed with a medical condition that is listed in the insurer’s claims set e.g. cancer, heart attack, stroke.

Critical illness cover for aerial riggers who work over 40 feet may be available at standard terms provided that the application is placed with the right insurer. Unfortunately it’s not possible to say that Insurer X is the right one for you as there are lots of things that come into play with choosing the best insurer for you.

Critical illness cover often comes with total permanent disability (TPD) included within the claims set. This is likely to be excluded for aerial riggers working at over 40 feet, but this should not cause any concern as there will generally still be at least another 50 conditions to claim on. Aerial riggers working below 40 feet will typically be able to secure standard terms for critical illness cover with most insurers.

Aerial Riggers & Income Protection

Income protection pays you a replacement of your monthly income, if you are unable to work due to ill health.

Aerial riggers income protection policies should be placed with an insurance provider who can offer an own occupation definition. It is important that you apply for an own occupation definition for the policy, rather than suited or any occupation definitions which are far harder to claim on. This is because your claim is then not based on being an aerial rigger but on your ability to perform any like job or any job at all, respectively.

Our financial advisers will place your application with the correct insurer to enhance the likelihood of your income protection policy being accepted at an own occupation definition.

Income protection for aerial riggers will come with a deferment period of 1 day, 1 week, 4 weeks, 8 weeks, 13 weeks, 26 weeks or 52 weeks. The deferment period is the amount of time that you must wait from becoming unable to work before the policy benefit will be paid out. You should consider any employment benefits, savings and budget for the income protection policy when you make the decision as to which deferment period suits your circumstances most.

Our financial advisers can help you to determine the most appropriate deferment period for your individual circumstances and we are happy to discuss the benefits of different options with you.

Aerial Riggers & Travel Insurance

We work alongside a specialist travel broker that can find the right policy for you. To find out more, please visit our travel page here.

Aerial Riggers

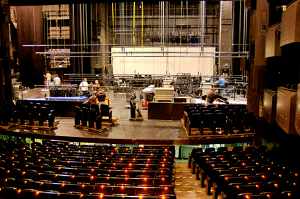

Aerial riggers are responsible for ensuring the safety of individuals across both professional and recreational activities. An aerial rigger may be employed to construct and maintain trapeze platforms, zip lines and gymnasium facilities (such as aerial yoga/pilates), to name but a few. Aerial riggers must not only provide safe environments for others to use, but must also ensure safe access for themselves and colleagues when constructing the rigs.

Example Occupations

- Circus rigger

- Theatre hand and dance technician

- Outdoor activity engineer

- Gym technician

Possible Risks

- Environmental factors

- Equipment safety

- Falls

Occupational Duties

- Human load rigging

- Health and safety

Further Reading and Research

By clicking on the link(s) above you will be departing from the regulatory site of Cura Financial Services. Cura Financial Services is not responsible for the accuracy of the information contained within the linked site(s).

Client Reviews

Cura Financial Services has been rated 4.9 out of 5 based on 831 reviews.

Review by Clare on 23rd April 2021

“Quick & efficient” - 5

You can read more of our reviews here.

- For more information on specific health conditions, pastimes, occupations and countries please select here:

Dr Kathryn Knowles Phd

Author

This page was written by Dr Kathryn Knowles Phd, an award-winning insurance adviser. To read more about Kathryn please see her bio here

Client Reviews

Talk to a Friendly Adviser

Get a Quote

What We Offer?

- Experienced and knowledgeable advisers

- Specialist advice with no fees to pay

- Full assistance with all of your paperwork

- Put your policy into trust at no cost

- A dedicated insurance adviser for you

Our Recent Awards